Direct Material Can Be Classified As Which Cost . direct material costs are the costs of raw materials or parts that go directly into producing products. — direct materials are those materials that are used to create a finished product, and their cost can have a significant impact on the. For example, if company a is a toy manufacturer, an. — what is direct material cost? Direct material cost is the cost of the raw materials and components used to create. — direct materials is an important concept in throughput analysis, where throughput is the revenue generated. — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. These costs can be calculated by adding up the cost of all components and dividing by the number of units produced.

from www.chegg.com

For example, if company a is a toy manufacturer, an. Direct material cost is the cost of the raw materials and components used to create. direct material costs are the costs of raw materials or parts that go directly into producing products. — direct materials is an important concept in throughput analysis, where throughput is the revenue generated. — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. These costs can be calculated by adding up the cost of all components and dividing by the number of units produced. — what is direct material cost? — direct materials are those materials that are used to create a finished product, and their cost can have a significant impact on the.

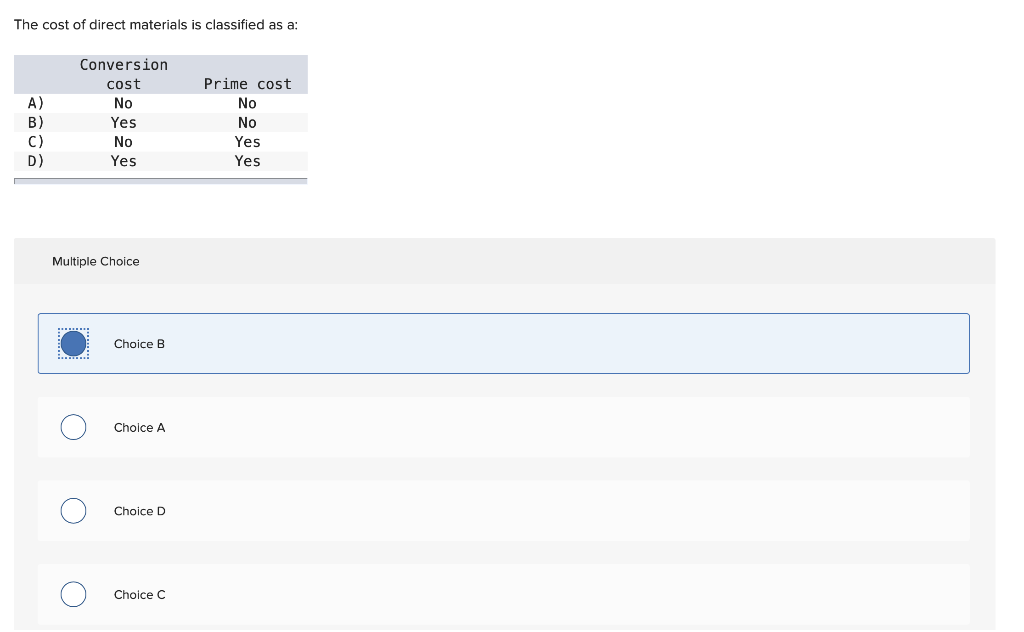

Solved The cost of direct materials is classified as a

Direct Material Can Be Classified As Which Cost — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. — what is direct material cost? direct material costs are the costs of raw materials or parts that go directly into producing products. — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. Direct material cost is the cost of the raw materials and components used to create. For example, if company a is a toy manufacturer, an. These costs can be calculated by adding up the cost of all components and dividing by the number of units produced. — direct materials is an important concept in throughput analysis, where throughput is the revenue generated. — direct materials are those materials that are used to create a finished product, and their cost can have a significant impact on the.

From efinancemanagement.com

What is Direct Material? Examples, Calculation, In Financial Statements Direct Material Can Be Classified As Which Cost — direct materials is an important concept in throughput analysis, where throughput is the revenue generated. Direct material cost is the cost of the raw materials and components used to create. — direct materials are those materials that are used to create a finished product, and their cost can have a significant impact on the. — direct. Direct Material Can Be Classified As Which Cost.

From www.youtube.com

Direct Materials Cost Definition, Types, Importance of Direct Direct Material Can Be Classified As Which Cost — direct materials are those materials that are used to create a finished product, and their cost can have a significant impact on the. Direct material cost is the cost of the raw materials and components used to create. These costs can be calculated by adding up the cost of all components and dividing by the number of units. Direct Material Can Be Classified As Which Cost.

From learn.financestrategists.com

Direct Materials Cost Definition Components Calculation Examples Direct Material Can Be Classified As Which Cost These costs can be calculated by adding up the cost of all components and dividing by the number of units produced. — direct materials is an important concept in throughput analysis, where throughput is the revenue generated. — direct materials are those materials that are used to create a finished product, and their cost can have a significant. Direct Material Can Be Classified As Which Cost.

From www.researchgate.net

Total Direct Material Costs Download Table Direct Material Can Be Classified As Which Cost — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. — what is direct material cost? For example, if company a is a toy manufacturer, an. direct material costs are the costs of raw materials or parts that go directly into producing products. Direct material cost. Direct Material Can Be Classified As Which Cost.

From learn.financestrategists.com

Direct Materials Cost Definition Components Calculation Examples Direct Material Can Be Classified As Which Cost Direct material cost is the cost of the raw materials and components used to create. — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. — direct materials are those materials that are used to create a finished product, and their cost can have a significant impact. Direct Material Can Be Classified As Which Cost.

From www.akounto.com

Cost of Goods Sold Definition & Calculation Steps Akounto Direct Material Can Be Classified As Which Cost For example, if company a is a toy manufacturer, an. — direct materials are those materials that are used to create a finished product, and their cost can have a significant impact on the. These costs can be calculated by adding up the cost of all components and dividing by the number of units produced. — direct materials. Direct Material Can Be Classified As Which Cost.

From www.slideserve.com

PPT Costs Terms, Concepts and Classifications PowerPoint Presentation Direct Material Can Be Classified As Which Cost Direct material cost is the cost of the raw materials and components used to create. — what is direct material cost? — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. For example, if company a is a toy manufacturer, an. These costs can be calculated by. Direct Material Can Be Classified As Which Cost.

From www.slideserve.com

PPT Management Accounting A Business Partner PowerPoint Presentation Direct Material Can Be Classified As Which Cost — direct materials is an important concept in throughput analysis, where throughput is the revenue generated. For example, if company a is a toy manufacturer, an. These costs can be calculated by adding up the cost of all components and dividing by the number of units produced. — direct materials are those materials that are used to create. Direct Material Can Be Classified As Which Cost.

From calculatemanhours.com

How to Calculate Direct Material Cost Direct Material Can Be Classified As Which Cost For example, if company a is a toy manufacturer, an. These costs can be calculated by adding up the cost of all components and dividing by the number of units produced. — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. direct material costs are the costs. Direct Material Can Be Classified As Which Cost.

From www.slideserve.com

PPT Chapter 2 PowerPoint Presentation, free download ID1130963 Direct Material Can Be Classified As Which Cost — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. direct material costs are the costs of raw materials or parts that go directly into producing products. For example, if company a is a toy manufacturer, an. These costs can be calculated by adding up the cost. Direct Material Can Be Classified As Which Cost.

From www.slideserve.com

PPT Management Accounting A Business Partner PowerPoint Presentation Direct Material Can Be Classified As Which Cost For example, if company a is a toy manufacturer, an. — direct materials are those materials that are used to create a finished product, and their cost can have a significant impact on the. — what is direct material cost? Direct material cost is the cost of the raw materials and components used to create. — direct. Direct Material Can Be Classified As Which Cost.

From fundamentalsofaccounting.org

Direct Materials Meaning and Examples Direct Material Can Be Classified As Which Cost direct material costs are the costs of raw materials or parts that go directly into producing products. Direct material cost is the cost of the raw materials and components used to create. — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. — direct materials are. Direct Material Can Be Classified As Which Cost.

From www.slideshare.net

Direct Materials Accounting Direct Material Can Be Classified As Which Cost — direct materials are those materials that are used to create a finished product, and their cost can have a significant impact on the. These costs can be calculated by adding up the cost of all components and dividing by the number of units produced. — direct materials costs are costs of any raw material, component, or stock. Direct Material Can Be Classified As Which Cost.

From www.inflowinventory.com

Calculate Your Cost of Goods Manufactured With This Formula Direct Material Can Be Classified As Which Cost — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. These costs can be calculated by adding up the cost of all components and dividing by the number of units produced. For example, if company a is a toy manufacturer, an. — direct materials are those materials. Direct Material Can Be Classified As Which Cost.

From www.chegg.com

Solved The cost of direct materials is classified as a Direct Material Can Be Classified As Which Cost For example, if company a is a toy manufacturer, an. direct material costs are the costs of raw materials or parts that go directly into producing products. — direct materials costs are costs of any raw material, component, or stock item that is used to manufacture a product. — direct materials are those materials that are used. Direct Material Can Be Classified As Which Cost.

From www.youtube.com

Elements of cost Direct and Indirect Material, Labor, & Expenses Direct Material Can Be Classified As Which Cost direct material costs are the costs of raw materials or parts that go directly into producing products. These costs can be calculated by adding up the cost of all components and dividing by the number of units produced. — direct materials are those materials that are used to create a finished product, and their cost can have a. Direct Material Can Be Classified As Which Cost.

From www.superfastcpa.com

What is Direct Material Cost? Direct Material Can Be Classified As Which Cost For example, if company a is a toy manufacturer, an. — what is direct material cost? direct material costs are the costs of raw materials or parts that go directly into producing products. — direct materials is an important concept in throughput analysis, where throughput is the revenue generated. These costs can be calculated by adding up. Direct Material Can Be Classified As Which Cost.

From pakmcqs.com

The costing method, in which the direct material cost is included in Direct Material Can Be Classified As Which Cost Direct material cost is the cost of the raw materials and components used to create. — direct materials is an important concept in throughput analysis, where throughput is the revenue generated. direct material costs are the costs of raw materials or parts that go directly into producing products. — what is direct material cost? These costs can. Direct Material Can Be Classified As Which Cost.